Mobile bank

- 5.0 RATINGS

- 6.00MB DOWNLOADS

- 4+ AGE

About this app

-

Name Mobile bank

-

Category FINANCE

-

Price Free

-

Safety 100% Safe

-

Version 4.18.0.4002935

-

Update Oct 28,2024

In the digital age, where technology permeates every aspect of our lives, mobile banking apps have emerged as game-changers, transforming the way we manage our finances. The concept of Mobile Bank encapsulates the convenience, security, and accessibility of banking services at our fingertips, anytime, anywhere. These apps have not only streamlined traditional banking processes but also democratized financial services, making them more inclusive and user-friendly.

Convenience Redefined

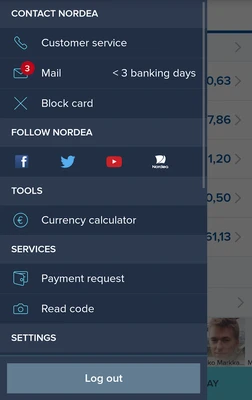

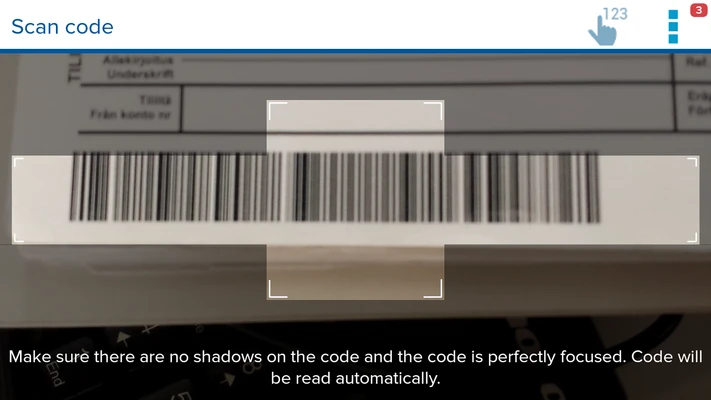

One of the most significant advantages of mobile banking apps is the unparalleled convenience they offer. Gone are the days of standing in long queues at bank branches or waiting for business hours to conduct basic transactions. With a smartphone and an internet connection, users can check account balances, transfer funds, pay bills, apply for loans, and even invest in stocks and mutual funds, all within seconds. This instant access to financial information and services has revolutionized personal finance management, enabling individuals to stay on top of their finances and make informed decisions on the go.

Enhanced Security Features

Concerns around security often deter people from embracing digital banking. However, modern mobile banking apps have addressed these fears with robust security measures. From multi-factor authentication, biometric verification (such as fingerprint or facial recognition), to encrypted data transmission, these apps ensure that user information and transactions are protected against unauthorized access. Additionally, real-time alerts and notifications keep users informed about any account activity, providing an added layer of security and peace of mind.

Personalized Financial Insights

Mobile banking apps go beyond just transactional services. They leverage advanced analytics and artificial intelligence to provide personalized financial insights and recommendations tailored to each user's spending habits and financial goals. Whether it's budgeting tools, savings plans, or investment advice, these apps empower users to make smarter financial decisions and achieve their financial objectives faster.

Financial Inclusion

Perhaps one of the most impactful aspects of mobile banking apps is their role in promoting financial inclusion. By eliminating geographical barriers and reducing the need for physical infrastructure, these apps make banking services accessible to individuals in remote areas and underserved communities. This not only improves financial literacy but also fosters economic growth and development in these regions.

Conclusion

In conclusion, mobile banking apps have fundamentally transformed the banking industry, making financial services more convenient, secure, personalized, and inclusive. As technology continues to evolve, we can expect these apps to become even more sophisticated, offering an ever-widening array of features and services. For consumers, the rise of mobile banking represents a shift towards a more empowered and connected financial future.